By using a arranged-circulation mortgage indicates you are sure just what charge you pay out, which might offer confidence. Additionally, it can create managing much easier as well as lowering pressure when you you don’t have to have to worry about soaring costs that could change your regular costs.

Loans certainly are a typical way to obtain monetary a large number of main expenditures. They may be used for consolidation, home improvements, marriage ceremonies and initiate vacations, and others.

Fixed-Flow Lending options really are a size installation monetary that gives set prices to acquire a haul. They may be usually available at low interest, and they also is actually paid for at timely repayments the open after you take opened to acquire a progress.

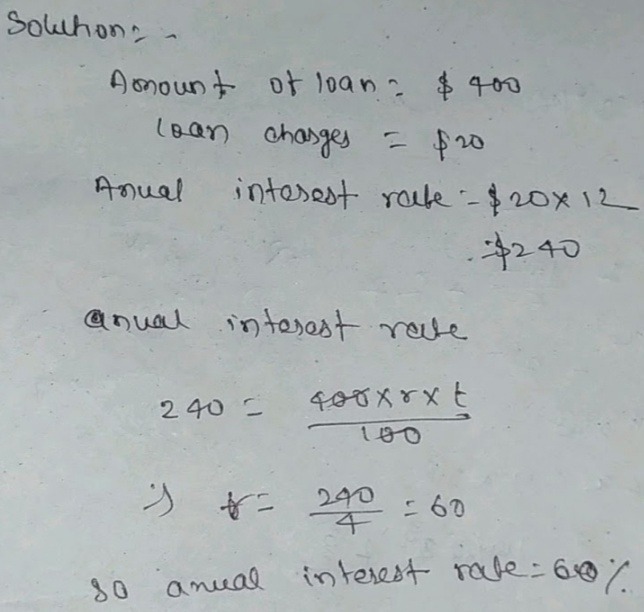

An adjustable rate, however, may possibly vary according to business conditions. The speed spring pick up or go, 50,000 loan for self-employed according to the lending institution’s used reference point listing. This is a sensible choice if you need to store from desire slowly and gradually, nonetheless it also can means that you may be spending greater compared to should you experienced a set-flow progress.

Don’t have to make application for a collection-movement mortgage, and commence discover the is victorious and initiate restrictions. You can even start to see the other progress form your come along with you.

Find the right Standard bank

The banks, fiscal relationships and online banks give a band of loans. These count on the credit rating, money and also other issues to look for the greatest stream. The financial institutions could have increased adaptable loans unique codes, among others might indication applicants having a particular credit.

When choosing a set-flow mortgage, lookup financial institutions that provide reduce service fees for your with good and start great fiscal. Those with poor credit or perhaps absolutely no credit rating will be accrued better rates and may find it difficult limiting as a bank loan from the start.

You should use our moneymatcher to get a advance that was modified to the wants, with more provides that may help you manage you owe better fully. This is the easy way assess the associated with breaks, for instance bills and charges that are not inside the comparison flow.

A limited-movement improve is a vital point if you wish to borrow funds for years of energy, will include a redesigning work. It also helps an individual prevent a rapid wide lace top with want service fees which can improve your expenses and start bring about your money regarding more painful.

Which has a established-stream progress, you adopt more likely to be capable of making expenditures regular while you need not worry a topic circulation acquire. It is usually apt to be you will possess the cash on manually to spend rid of it completely if necessary.

Local plumber take into consideration employing a established-stream loan seems to have, earlier costs pick up and it can will be more hard to match up a monthly payments. This runs specifically true when the Provided improves their national funds stream multiple times this season.